The Complex Landscape Of Taxation In The Online Gaming Industry

The Complex Landscape of Taxation in the Online Gaming Industry

Related Articles: The Complex Landscape of Taxation in the Online Gaming Industry

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Complex Landscape of Taxation in the Online Gaming Industry. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Complex Landscape of Taxation in the Online Gaming Industry

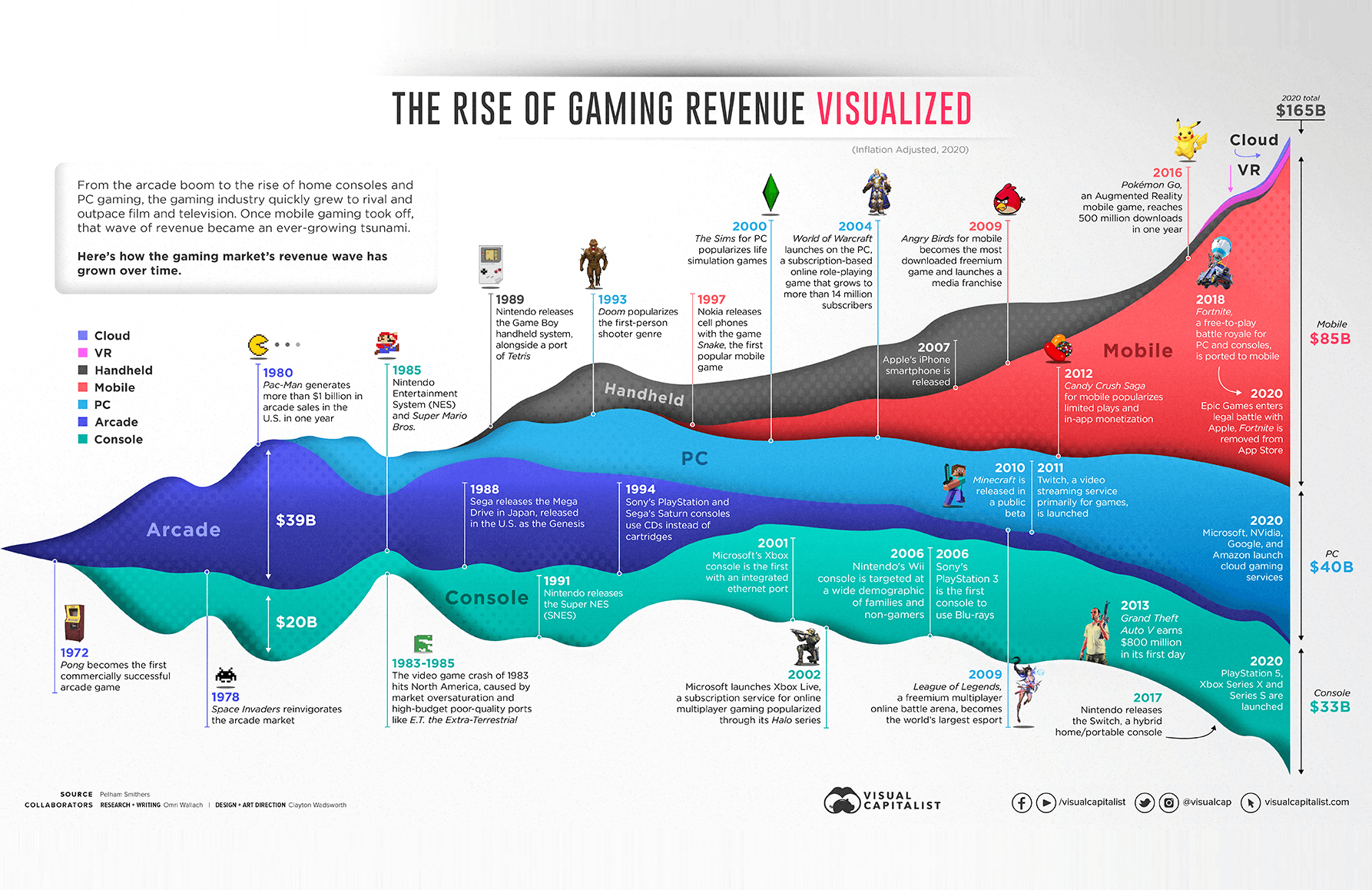

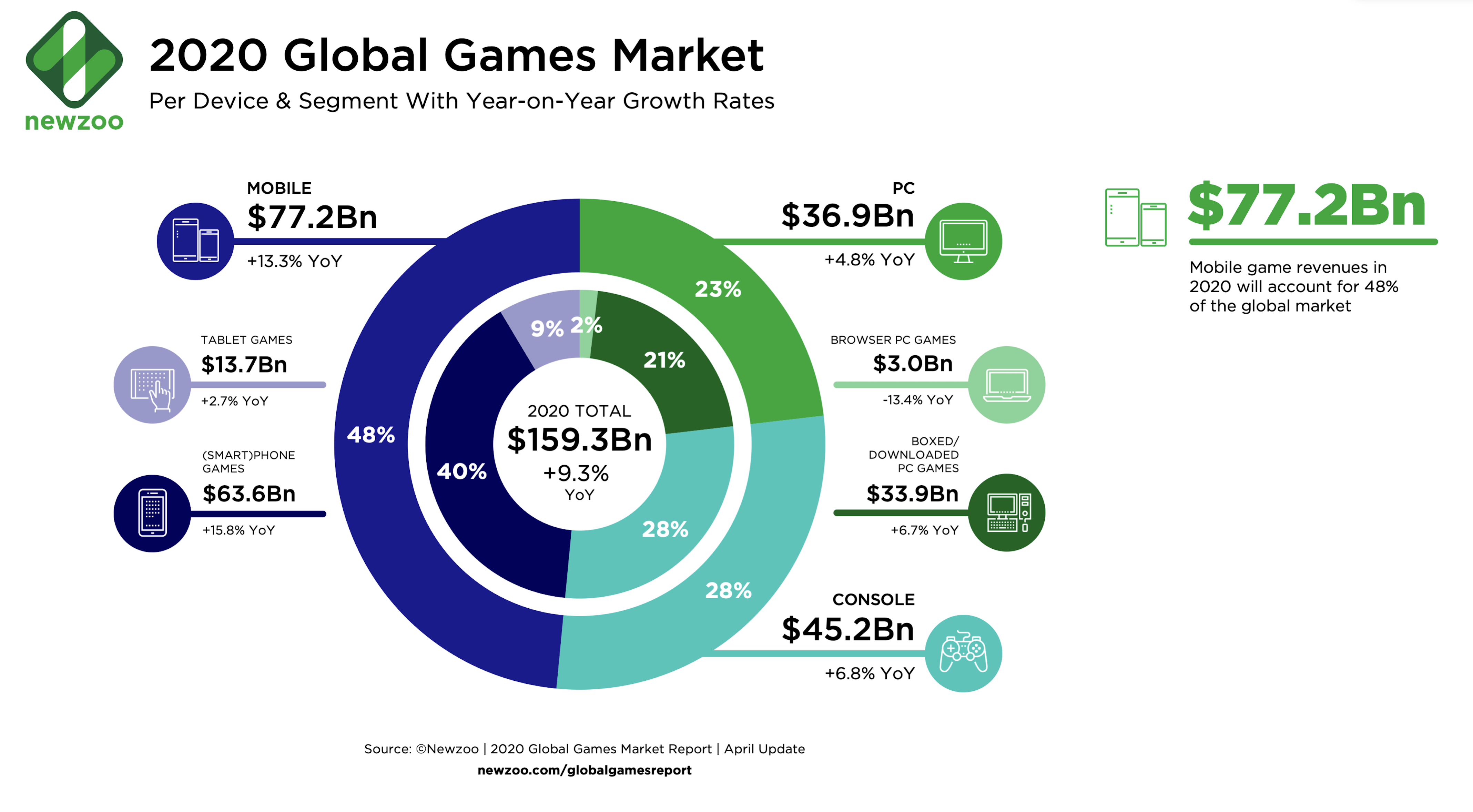

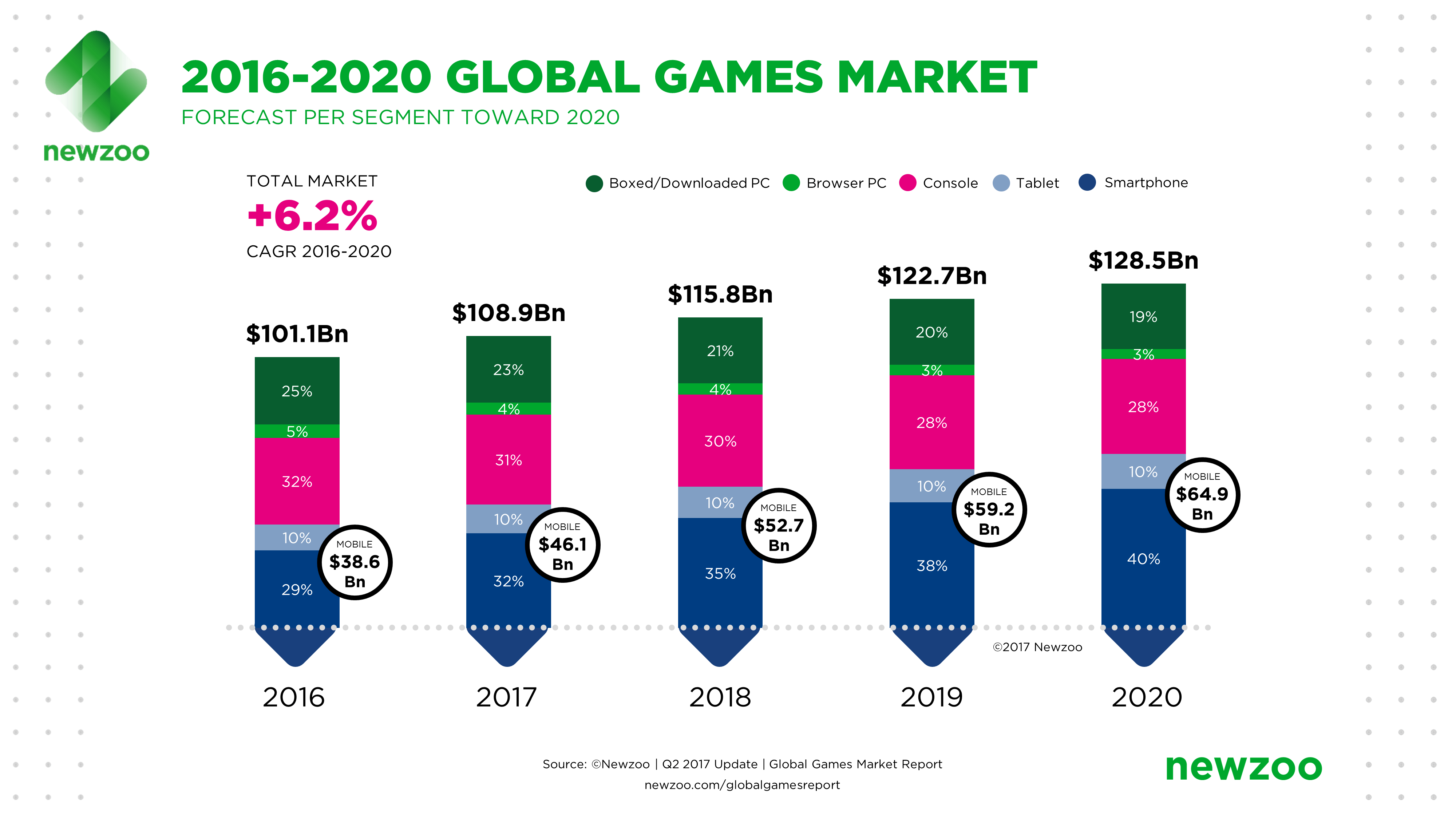

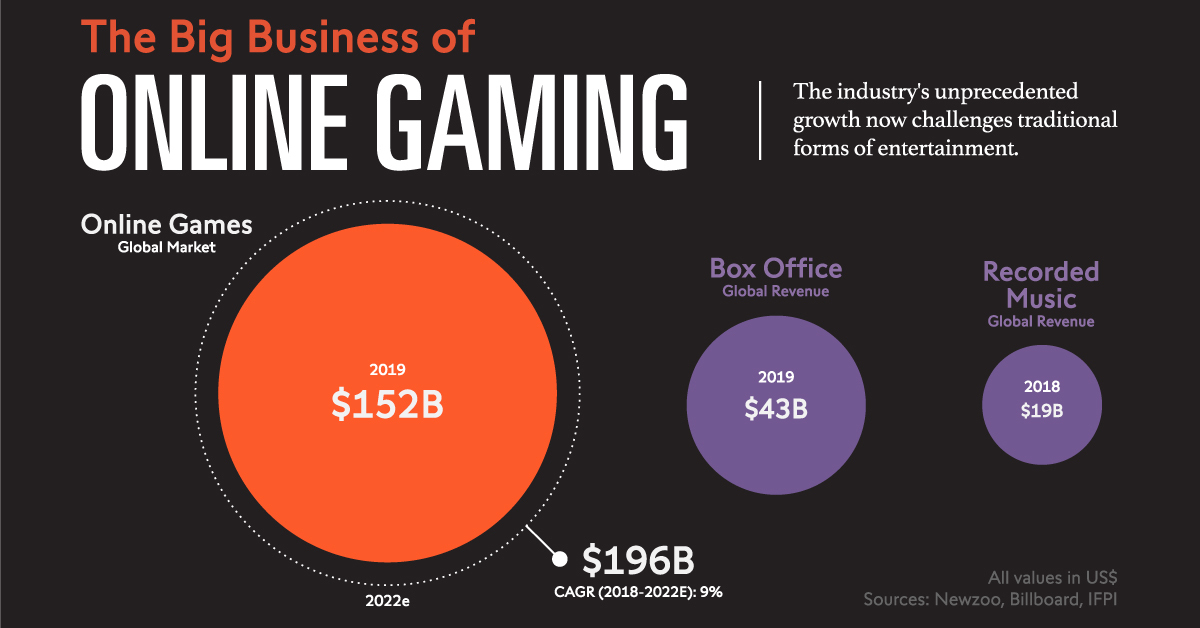

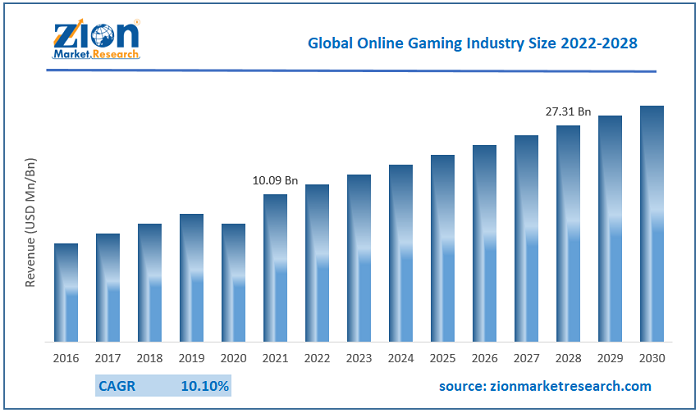

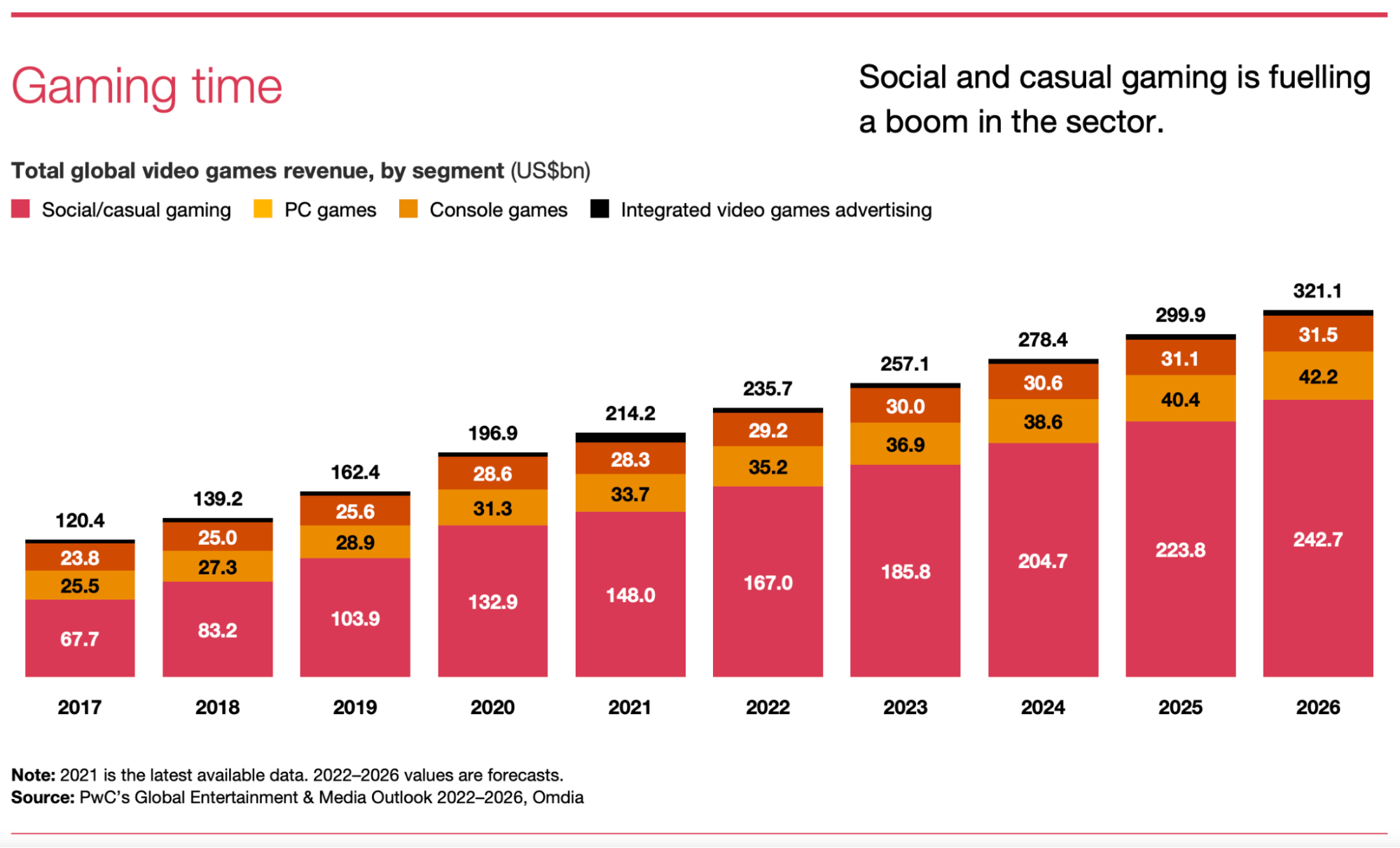

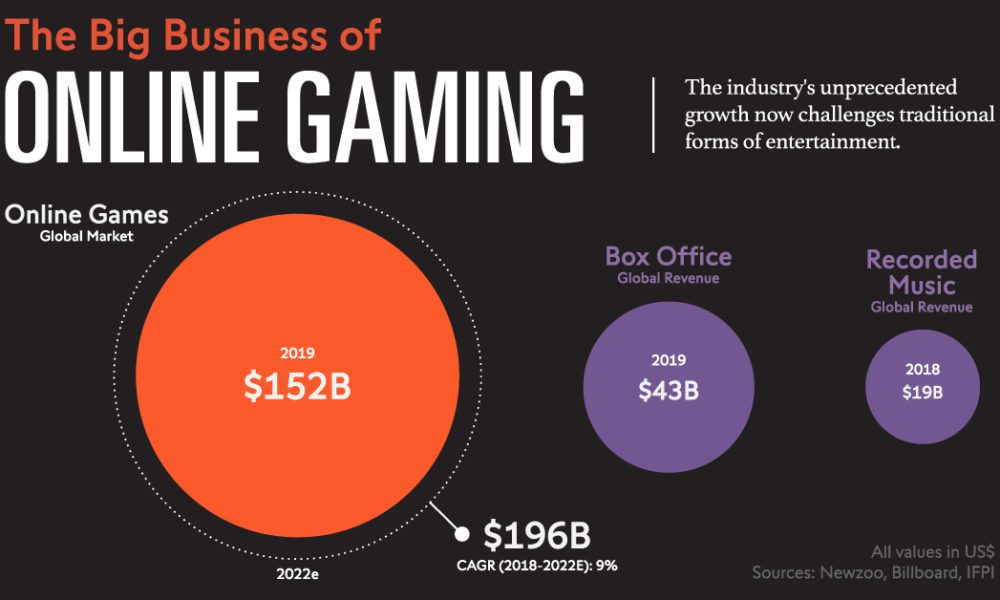

The online gaming industry has exploded in recent years, becoming a multi-billion dollar global phenomenon. This growth has brought with it a complex web of regulations, particularly concerning taxation. Understanding the intricacies of how online gaming income is taxed is crucial for both players and game developers alike.

Taxation of Online Gaming Income: A Multifaceted Approach

Taxation of online gaming income varies significantly depending on several factors, including:

- Jurisdiction: The specific tax laws and regulations governing online gaming differ across countries and regions.

- Nature of Income: The type of income generated from online gaming, such as winnings from esports tournaments, virtual item sales, or subscription fees, can influence tax implications.

- Player Status: Whether the individual is a casual player or a professional gamer can impact their tax obligations.

Taxation for Players:

For players, the primary source of income from online gaming is typically winnings from tournaments or competitions. However, the tax treatment of these winnings can differ greatly.

- Casual Players: Casual players who engage in online gaming for entertainment purposes and do not generate significant income from it are generally not subject to income tax on their winnings.

- Professional Gamers: Professional gamers who earn a substantial income from online gaming are typically required to declare their winnings and pay taxes on them as self-employed individuals. The specific tax rates and reporting requirements depend on the individual’s location and the nature of their income.

Taxation for Game Developers:

Game developers face a more complex tax landscape. Their income can stem from various sources, including:

- Game Sales: Revenue generated from selling games on platforms like Steam or the App Store is subject to taxes in the developer’s jurisdiction.

- In-Game Purchases: Sales of virtual items, subscriptions, and other in-game purchases are also subject to taxation.

- Advertising Revenue: Developers may generate income from advertising within their games, which is also taxable.

Tax Obligations for Game Developers:

Game developers are generally required to:

- File Income Tax Returns: They must report their income from game development and pay applicable taxes.

- Pay Sales Tax: In some jurisdictions, they may be obligated to collect and remit sales tax on game sales and in-game purchases.

- Comply with VAT Regulations: In countries with Value Added Tax (VAT), game developers may need to register for VAT and charge VAT on their sales.

The Role of Virtual Currency in Online Gaming Taxation:

The emergence of virtual currencies, such as Bitcoin and Ethereum, has further complicated the tax landscape for online gaming.

- Tax Treatment of Virtual Currency: The tax treatment of virtual currency varies by jurisdiction. Some countries classify it as a currency, while others consider it property.

- Taxable Events: Transactions involving virtual currency, such as buying, selling, or exchanging it for other currencies, can trigger tax obligations.

- Reporting Requirements: Players and developers may need to report their virtual currency transactions to tax authorities.

Challenges and Opportunities in Online Gaming Taxation:

The rapid evolution of the online gaming industry presents unique challenges for tax authorities.

- Cross-Border Transactions: Online games often involve transactions across borders, making it difficult to determine the appropriate jurisdiction for taxation.

- Tax Avoidance and Evasion: The anonymity of the internet can facilitate tax avoidance and evasion.

- Lack of Clear Regulations: The lack of clear and consistent regulations across jurisdictions can create uncertainty for players and developers.

However, these challenges also present opportunities for governments to modernize their tax systems and ensure fair and equitable taxation of online gaming income.

FAQs on Online Gaming Taxation:

Q: Do I need to pay taxes on my online gaming winnings?

A: The tax treatment of online gaming winnings depends on your jurisdiction and the nature of your income. Casual players may not need to pay taxes on small winnings, while professional gamers are generally required to declare and pay taxes on their income.

Q: How do I report my online gaming income?

A: The specific reporting requirements vary by jurisdiction. You may need to file a tax return as a self-employed individual or include your winnings in your regular income tax return.

Q: Do I need to pay taxes on in-game purchases?

A: In-game purchases are generally subject to sales tax, depending on your jurisdiction.

Q: What are the tax implications of using virtual currency in online games?

A: The tax treatment of virtual currency is complex and varies by jurisdiction. You may need to report transactions involving virtual currency to tax authorities.

Tips for Navigating Online Gaming Taxation:

- Consult with a Tax Professional: Seek guidance from a qualified tax advisor to ensure compliance with applicable laws.

- Keep Accurate Records: Maintain detailed records of your income, expenses, and transactions related to online gaming.

- Stay Informed: Keep abreast of changes in tax regulations and guidance.

- Consider Tax Planning: Explore strategies to minimize your tax liability, such as taking advantage of deductions and credits.

Conclusion:

The taxation of online gaming is a complex and evolving area. Players and game developers need to be aware of the relevant tax laws and regulations in their jurisdictions to ensure compliance. By understanding the tax implications of online gaming, individuals can navigate this landscape effectively and avoid potential penalties. As the online gaming industry continues to grow, it is crucial for governments, players, and developers to work together to establish clear and transparent tax policies that promote fairness and sustainability.

Closure

Thus, we hope this article has provided valuable insights into The Complex Landscape of Taxation in the Online Gaming Industry. We appreciate your attention to our article. See you in our next article!